USA Government Tax Credits & Incentives

Recovery Service

Most Have Heard of PPP, ERC & RnD, but There's 100s More!

Gain Access to the "QuickBooks" of Tax Credits & Incentives

Qualify for Lucrative Incentives Every Year - Reliable Residual Income Awaits!

There is Over a TRILLION Dollars to be Claimed

To Claim Your Benefits - Get Started & Use Our FREE Calculator Today!

Who Is The Service For &

What Do We Do?

This service is for ALL American (USA) organizations (businesses, medical, non-profits, etc.)that pay taxes, with 1 or more employees and/or own commercial property.

Our Fintech SaaS solution is the “QuickBooks” of Business Tax Credits & Incentives.

With over a Trillion Dollars being given away by local, state, and federal governments, our system will sort through 100s of Tax Incentives & Credits (single & repeating) and identify which you are entitled to claim. You choose which to claim, and we get the money sent directly to you from the IRS. Quick and Easy.

We can discover even more residual money-making opportunities if you own commercial property.

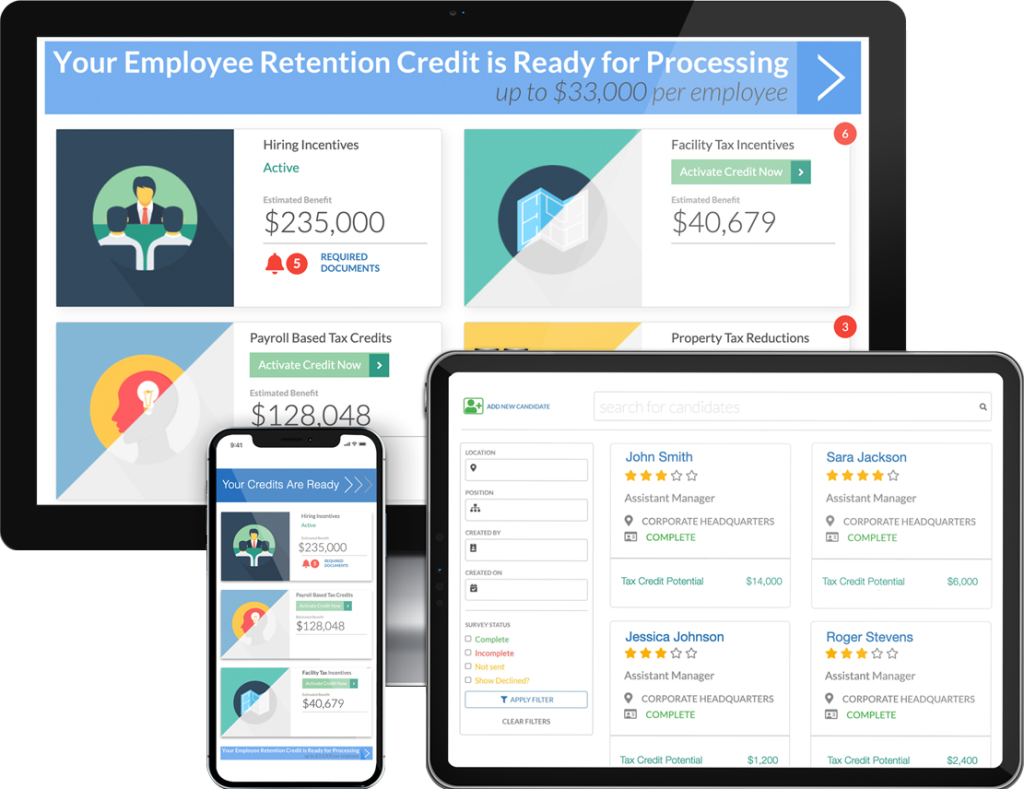

Your Tax Management System (TMS)

Your All-in-One Solution for Tracking Employees as well as Tax Credits!

Within our platform, you will be able to monitor all current employees, past employees (up to four years) retroactively, as well as new potential job candidates.

With each person, it will display the qualifying amount of tax credit. From here, you can begin claiming the credit with ease.

Get a visual display of all available tax credits. Stay organized and see the required steps or required documents for each credit.

Results

Our Track Record Speaks For Itself.

Since 2004, 38 Billion has been Claimed So Far (As of 04/23).

0 remittances. Meaning nothing we submit has ever been declined.

The Results Prove We Are 100% IRS Approved.

Modest examples for some of the larger well-known programs:

Home Healthcare Company

ERC (150 employees)

Benefit: $3,650,250

Retail Establishment

Cost Seg

Benefit: $758,388

Manufacturer

R&D (280 employees)

Benefit: $600,000

Food Processing Facility

WOTC (1000 hires/yr)

Benefit: $528,000

Software IT Company

ERC (278 employees)

Benefit: $6,765,589

Apartment Complex

Cost Seg

Benefit: $1,344,183

Value & Why Us?

When you choose us, you’re choosing a partnership that brings substantial value:

- Expert Team & Partners: Since 2004, our highly skilled team of professionals and partners have worked diligently behind the scenes to secure the incentives and credits you deserve, handling all aspects with zero time and paperwork for you.

- Zero Risk: Use our Free Calculator to instantly see what you are owed on top incentive programs, ranging from thousands to millions.

- Zero Cost: Your returns far exceed fees, so it pays for itself.

- Proven: Our service has helped hundreds of customers and maintained a 100% success rate.

- Can You Do It Yourself? If you and all businesses could, this service wouldn’t be needed. Finding and claiming all incentives manually is essentially impossible. We are here and ready to help with a cutting-edge system employing the latest in AI to ensure nothing is missed.

- Create a New Revenue Stream: Get an edge on your competition and unlock a significant, predictable, and reliable income source that frees up working capital for your business’s improvement and growth.

- Direct: All recovered funds are paid directly to you.

- Fast Setup: The entire process only takes about an hour and a half to set up on your side, and we take it from there.

- Simplified Process: We streamline and automate everything with our virtual platform, making it quick and effortless to submit information online.

- Free Money: Benefit from 100s of incentives painlessly, with instant filing and tracking for a reliable residual income, year after year.

- Fast Returns: Our Tax Management System (TMS) delivers your fastest returns, sometimes in a matter of days, with ongoing claims all year.

- Lucrative Returns: Discover incentives ranging from thousands to millions, many reoccurring, making it a no-brainer for businesses seeking substantial gains year after year.

- For example, A Cost Segregation Study yields an average benefit of $200,000 per property, and our system can deliver these returns in just a few days!

- Security: Everything is secure, ensuring the confidentiality of your information.

- Added Value: You gain an advanced HR management system. Our TMS offers added value by efficiently tracking employee records, managing HR functions, generating detailed reports, and identifying top-performing new hires to maximize tax incentives.

Discover the potential return with 0 Risk using our FREE Calculator. Don’t miss this risk-free opportunity to see what you can gain! Fill out the form below to gain access now!

You Can't Lose

We are dedicated to your satisfaction.

Zero Loss: Using the calculator is risk-free, and even if it shows no returns, you’ve gained the knowledge that you’re not missing out.

Significant Benefits: If the calculator shows potential returns, they will far outweigh the cost of the service and continue benefiting your business in the long term.

In the end you can feel confident that you’ve taken every step to secure free government incentives and credits, maximizing your revenue potential.

Cost & Fees

We have designed our pricing structure to be fair, transparent,

and in your best interest:

There is Zero Cost to access the calculator to see if we can help you.

If you find credits and incentives, the cost to access the “QuickBooks” like solution website is comparable to other software as a service companies like Netflix at $9 a month.

Paywall Vs. Free: Our $9 service fee is a nominal amount that separates the serious from the not-so-serious. It’s a small investment that can motivate you to claim your tax credits and incentives. Considering the substantial returns, it becomes meaningless.

There is 0 setup fee, no long-term contact, and you can cancel anytime. Each tax incentive may also include a performance-based commission for us to cover the cost and efforts behind the scenes in claiming the incentives and credits for you.

- For example, we may earn 10% of a $10,000 claim, which would be $1000. Each incentive and credit will have its structure, which is disclosed when you activate that particular service.

- Outside of that, if there is other tax or financial assistance you would like, those fees and or performance commissions would be determined on a case-by-case basis.

Our pricing is fair, there is no risk to you, and the rewards are significant. There is no reason not to use the free calculator to see what you can gain!

Requirements For Us to Help You

This service is for ALL American businesses, medical, and other organizations with 1 or more employees and/or own commercial property.

We help you track & claim 100s of Tax Incentives & Credits from local, state, and federal governments annually.

The Process & Time

Our streamlined process ensures efficiency and minimal involvement from your side.

Step 1. 20 Seconds: Gain instant access to our free calculator by filling out the form below, allowing you to estimate your potential tax incentives and credits in some key areas.

Step 2. 2 Minutes: If you like what you see, follow the simple process to sign up for the service.

Step 3. 1 Hour or Less: Enter the necessary information into our user-friendly system. Based on your data, we’ll present you with a page showcasing all the incentives and credits you can claim. With hundreds to qualify for, you’ll have numerous opportunities to benefit!

Step 4: Monthly: The TMS (Tax Management System) will help your employees manage HR functions, track employee records, enter new hires, download reports, and review potential new hire benefits, enhancing your team’s efficiency.

So in just about an hour and a half, you’ll have everything setup to start receiving money for as long as you’re in business, as the government continuously offers incentives. With a steady flow of income, you’ll discover that the service more than pays for itself. Embrace the opportunity to maximize your business’s financial potential, access more working capital and predictable funds to grow your business!

What's Next?

We strive to build long-term partnerships and continue delivering value to our clients. If you are satisfied with our services, which we are confident you will be, you just continue with us and keep collecting your money year after year for as long as you are in business.

Why Do This Now? The Cost of Waiting.

Every day you delay, it can cost you big money.

Here’s why:

- Every local, state and federal program works in cycles.

- So if you don’t get in at the right time you miss out.

- Missing Out can mean you will NEVER be able to make the claim because it will no longer be offered. An example is the PPP (Paycheck Protection Program) which pays large amounts for every employee yet is expiring soon.

- Or Missing Out can mean you have to wait until next year to claim that one.

The bottom line is that every day you wait means getting closer to or passing a deadline. If you miss the deadline, you lose, which sometimes means big money.

Don’t Miss Out on FREE MONEY!

Collect Every Credit & Incentive!

Use the Free Calculator Now!

Option 1: Claim Your Free Access to the Credit & Incentive Calculator Now!

Clicking the button below will take you to our free calculator where you can fill in some basic information to see if you qualify for a few of the top incentives and credits. If you like what you see you can register then choose all the tax credit and incentives you wish to receive.

Option 2: Introduction Meeting

Gain Access to Our Calendar &

Choose a Time to Meet.

If you want to meet before deciding, click the button below to access our calendar. From there, you can schedule the introduction at your convenience.

Take the first step towards exploring our services! We look forward to speaking with you!